Humber students can find tax support with CRA tips and tricks this year, easing another stressful task to be completed.

Canada Revenue Agency (CRA) commenced its tax season operations on Feb. 19, inviting Canadians to begin filing their 2023 income taxes.

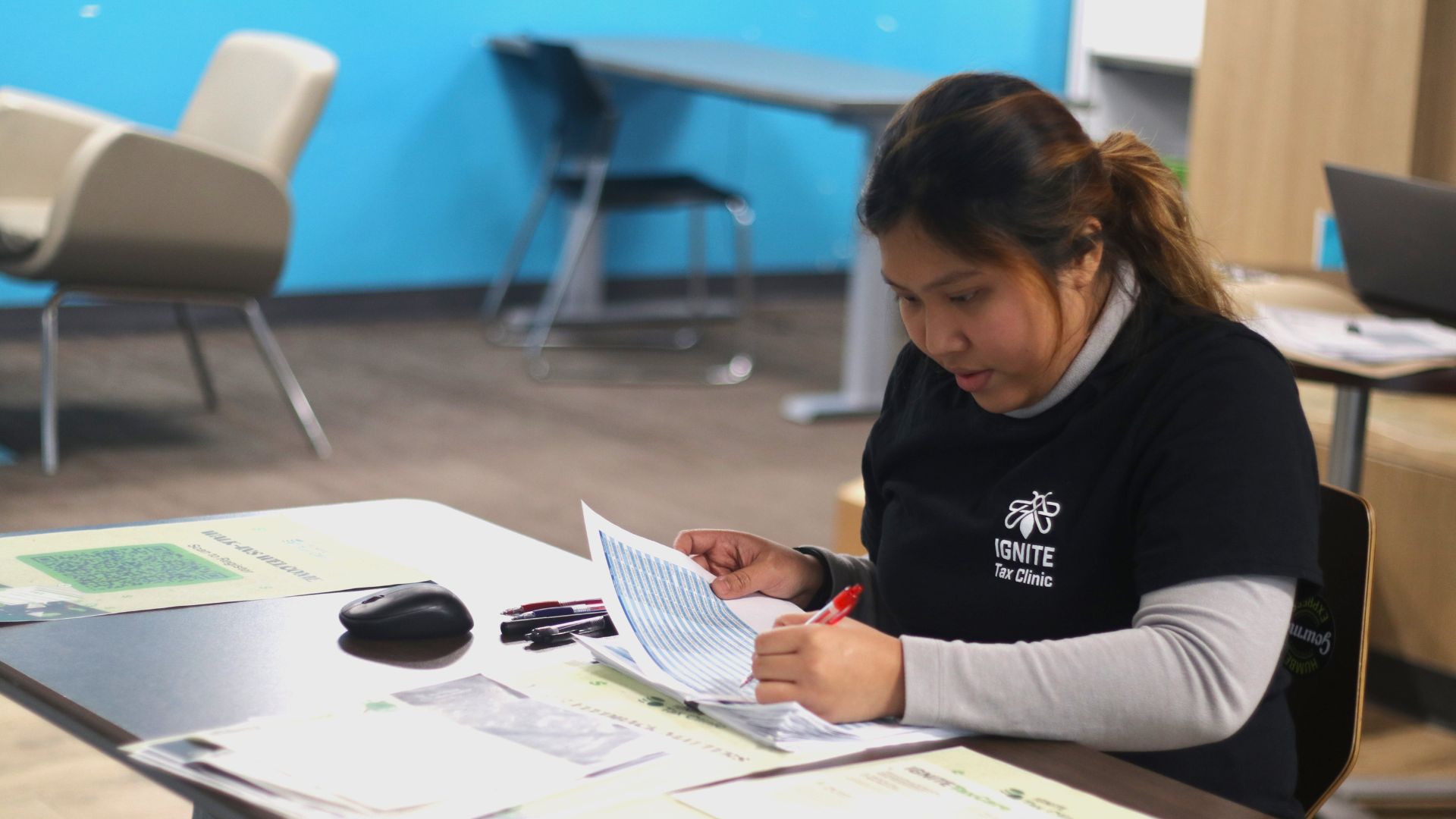

IGNITE, the student-led organization at Humber, said it has launched a comprehensive tax assistance program named Tax Clinic.

Humber said this initiative aims to simplify the tax filing process and provides access to trained student volunteers who offer expert guidance and support throughout the process.

Ada Ozonwanji, Career Success Manager at IGNITE said almost half the students don’t file taxes in their first year.

“Around 30 to 50 per cent of the newcomer students don’t file taxes in their first year,” Ozonwanji said.

She said the reason is a lack of awareness and they don’t know how to do it.

“In the IGNITE Tax Clinic, we offer students and low-income earners support to file simple taxes for free. If they were to seek external assistance for tax filing, it cost them charges ranging from $70 to $150, often without receiving adequate returns,” she said.

She said that they make students do it by themselves and guide them throughout the process so that they can learn.

In the 2023 tax filing season, Canadians submitted more than 32 million tax returns, with more than 92 per cent of them done online.

Canada said there were 18 million refunds last year, averaging $2,262 each.

The agency said taxpayers must mark their calendars as the deadline for filing taxes this year is April 30, as failing to submit a tax return by the deadline can result in substantial penalties.

It said that this penalty amounts to five per cent of the outstanding balance, plus an additional one per cent per month for up to 12 months.

Consequently, the agency said taxpayers could incur a maximum late filing penalty of 17 per cent.

The federal government said for self-employed individuals, along with their spouse or common-law partner, the deadline to file tax returns is June 15. Since this date falls on a Saturday, returns will be considered filed on time if received by or postmarked on or before June 17.

Paul N. Murphy, Senior Communications Advisor at CRA said in an interview with Humber News there are many key aspects of the 2024 tax season.

Murphy said several new tax measures were introduced for the 2024 tax season, including the Multi-Generational Home Renovation Tax Credit, First Home Savings Account and the Advanced Canada Workers Benefit.

“These measures aim to provide support to families, first-time homebuyers and individuals in the workforce,” Murphy said.

He said that filing taxes is not only about paying taxes but also about accessing various credits and benefits tied to tax filings, such as the Canada Child Benefit and GST/HST credit.

Murphy said that it is important for students also to file their tax returns.

“One of the reasons to file a return is to get credit for your tuition tax credit. You may not need it because it’s a non-refundable credit. So if you don’t have tax otherwise payable, you don’t get it back,” he said.

“But you should report it anyway because it carries forward from year to year, every year that you have tuition credits, you report them to add up until you have taxable employment income or other sorts of income. Then you can use them, claim them against your income after you have graduated,” Murphy said.

Additionally, he said that students have the option to transfer up to $5,000 of tuition tax credits to a parent, grandparent, spouse or common-law partner.

The CRA also provides resources such as My Account which is a secure web portal for tax management and reissuing uncashed checks.

“Students can expand their understanding of tax matters by enrolling in the “Learn About Your Taxes” online course on the CRA website,” Murphy said.

CRA’s helpline service is 1-800-959-8281 from Monday to Saturday, and offers assistance with tax inquiries and account-specific concerns, ensuring personalized support.