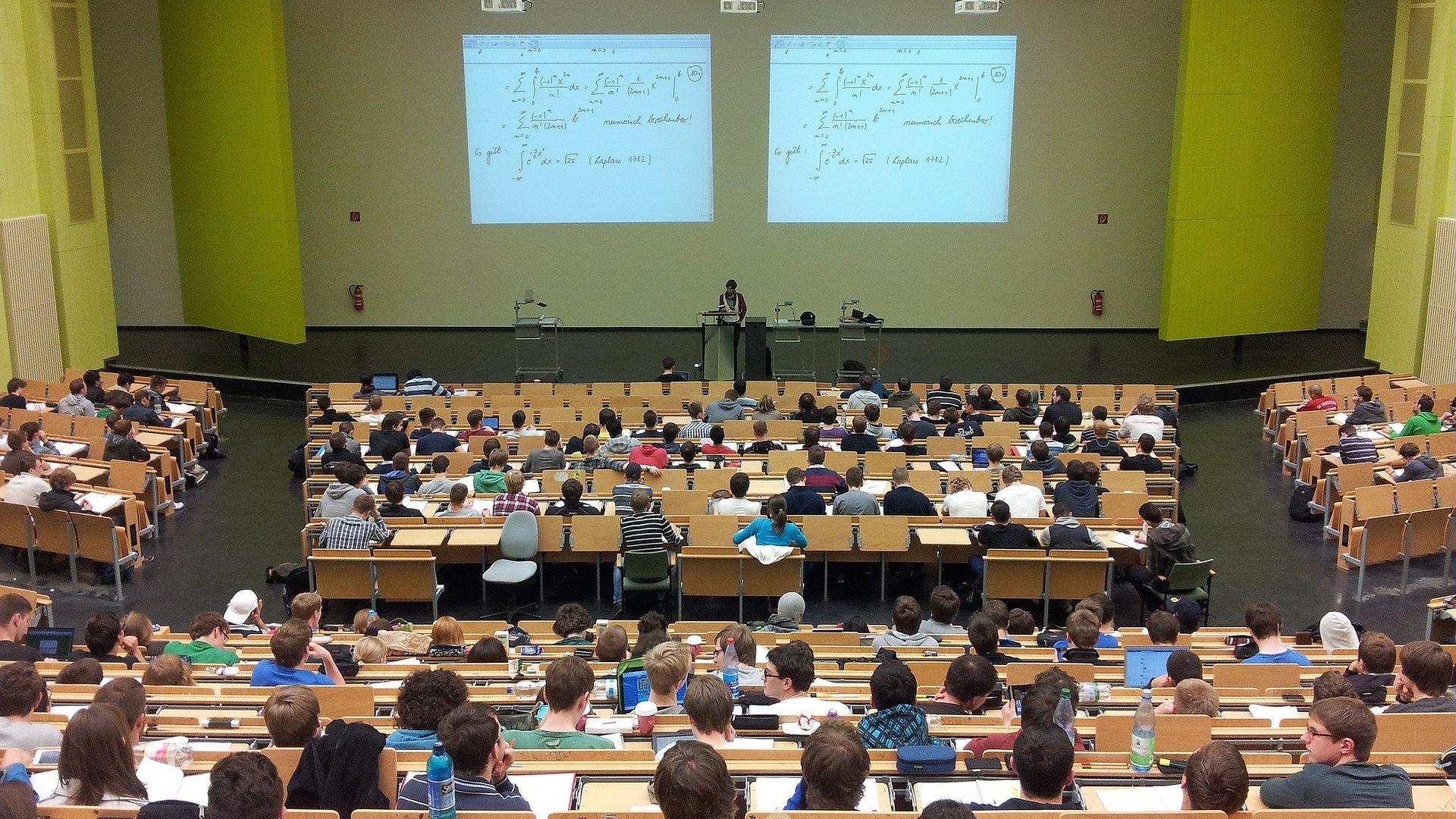

Premier Doug Ford’s government has slashed loans and grants for post-secondary students across the province, and students are stressed about it. (Nikolay Georgiev/Pixabay)

Abbie Jack

Summer is just beginning and students across Ontario are stressed about making enough money to pay for tuition this fall.

Ontario Premier Doug Ford announced changes to post-secondary funding in January and students learned last week on the Ontario Student Assistance Program (OSAP) website just how much these changes would financially affect them.

Ford reduced tuition by 10 per cent, but this was coupled with cuts to student loans and grants for Ontario universities and colleges.

Will Wuehr, communications director for Ontario Young Liberals, said it is disheartening that students in 2019 are receiving less support from OSAP than in past years.

“As someone who was never fortunate enough to study while tuition was free, I understand the pressure it puts on students,” he said. “I think the biggest lesson to take from this situation is how important it is to vote in every election, and as Ontario Young Liberals communications director, I’m proud to stand by my party’s record on post-secondary education.”

Alex Nixon, a 25-year-old York University student, was shocked and upset when she initially heard about the changes made by the government.

Nixon juggles her busy schedule during her school year at Glendon College by balancing her double major of drama and French studies with serving tables.

“I compress all of my classes into all day Monday and Tuesday for both semesters so I can pick up more shifts at work during the school year,” she said.

Nixon said she worked 20 hours per week serving to make money for school despite the loans and grants last year.

She said she isn’t sure how she will come up with enough money with the cuts this fall.

Nixon said she is disappointed because she will now spend her summer working to make enough money for the fall.

“Summer means weddings and big milestones for my friends, but because I have to worry about getting more shifts in the service industry, my entire summer is basically written off,” she said.

https://twitter.com/alexbrookenixon/status/1143510949686579200

Nixon said she worries a lot about her future finances.

“I can barely afford the general life costs of being in my mid-20s attending a school in one of the richest neighbourhoods in the GTA, so I’ve had moments of weakness where I debate just dropping all of it and trying to climb the restaurant management ladder,” Nixon said.

Vianca Wagan, a recent graduate from University of Toronto at Mississauga, had help from OSAP loans and grants during the first three years of her undergrad.

“My program, Psychology, was deregulated, so it helped to cut the amount I would have to save up in the summer to pay tuition,” she said. A deregulated program’s fees are higher than regulated courses, and OSAP amounts could be larger.

Wagan said that without OSAP she would have most likely taken a year off after high school to work full time in order to save for university.

This September, Wagan is going back to school for another degree and she said she is already worrying about making ends meet.

“All of my earnings from my two part-time jobs will go to paying for tuition, books, and commuting fares,” Wagan said.

Plus, without the grace period for paying off loans, there’s pressure to get a job right away after graduation to avoid a financial bind which is a lot of added stress, she said.