By: Ed Hitchins

Three former prime ministers, two billionaires, and a fundraiser walk into a bar.

While it sounds like a bad joke, in actuality, it’s quite serious.

In the ‘Paradise Papers’ released on Sunday, 3,300 Canadians were named in the leak of records from offshore law firm Appleby and the corporate registries of over three dozen tax havens.

This number is more than five times the amount of Canadians listed in the ‘Panama Papers,’ a similar document leak of released in 2016.

The list includes Stephen Bronfman, chief fundraiser for the Liberal Party and a man often associated Prime Minister Justin Trudeau’s rise to power. Documents show Bronfman moved millions of dollars in offshore accounts for former Senator Leo Kolber.

The list of 120,000 includes late William Markland Molson, who set up a offshore trust in Bermuda with the help of Appleby before his death in 2006.

Carl Dare, the late head of the massive cookie empire that bears his name, hired Appleby to set up a trust in 1975. The documents show that nearly $5 million was invested in the Cayman Islands before his death in 2014.

Also listed in the papers are Queen Elizabeth II, who held investments in both the Cayman Islands and Bermuda, rock band U2 lead singer Bono, and the NHL’s Montreal Canadiens, who set up an employee fund with the help of Appleby in Bermuda. The fund was closed in 2010.

In a statement, a spokesperson for the hockey club said “Any use of such a structure by [the club] was in full compliance of the existing Canadian tax legislation and was reviewed by the Canadian Revenue Agency (Revenue Canada at the time).”

Canadians for Tax Fairness Communications coordinator Diana Gibson says that the release of the papers shows that in the world of the wealthy, there are several eggshells to tip toe around.

“Canada has tax treaties that facilitate the use of tax havens by companies and individuals, dating back to 1980 signing one with Barbados,” Gibson said “There are several now. There are provisions which help make it easier.”

Gibson said in the future, the Liberals do need to get a little tougher.

“The real issue is that the taxes changed under previous governments needs to be changed. They need to be re-drafted on tax haven use and to clamp down on it. We do applaud the Trudeau government’s stance on investigating tax haven use with the internal investigation [into the Panama papers] and increased funding into the Canadian Revenue Agency. But, with this news, the law obviously needs changing, as it’s still grossly inadequate.”

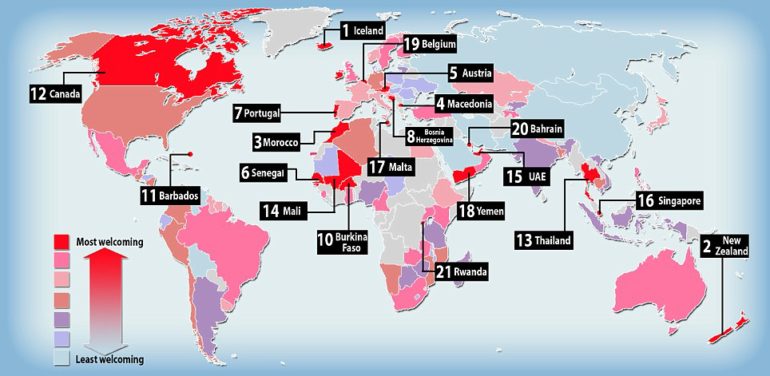

A brief infographic on the documents can be seen below.

nbsp;